Budgets have come and budgets have gone. Ruling party is happy, opposition party is not. We need an FM who can balance. The experts have given this budget more than 7 out of 10, which is really good. The FM has done a balancing act by satisfying everyone who do not want tax increase and scope of additional tax category is almost zero under the prevailing circumstances. No budget can make everyone happy. Let us be happy with what we have got and move on.

The biggest takeaway of this budget is not going for rebates and exemptions for income tax payees and going for 5 slabs with increased ceiling limits, just paving for the continuity of the new regime with much more sops. FM has said, “Your savings, your investments in higher returns rather than blocking your funds just for tax saving.”

The only negative side is that there should have been more boost for EOUs and STPIs to encourage exports by way of tax concessions.

Let us wait and watch. Government may rethink and amend later.

HIGHLIGHTS OF BUDGET ANALYSIS- TAX IMPACT

Income Tax:-

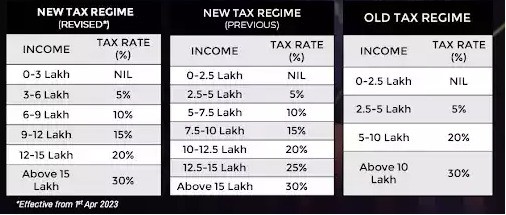

- A) Reduced highest tax rate now at 39% from 42.7%.

B) Surcharge now reduced to 25% from 37%.

Analysis: This is a welcome move for the salaried individuals and other business/professional individuals. Tax has been lowered to 5 slabs from the previous 6. Surcharge reduced.

Eg:

Old Tax Regime New Tax Regime

Salary Rs.7 lakhs 7 lakhs.

Less Exemptions 1.7 lakhs 0

Tax on the same 18,500 25,000

(As the income exceeds, one has to check his investments and other eligibility of rebates of old tax regime and calculate tax as per old and new tax regime and use the beneficial).

- 44AD presumptive scheme – This is available for proprietary/individual business clause.

Limit of Turnover increased to 3 crores from 2 crores.

Analysis: The traders and other businesses up to a turnover of 3 crores can declare a profit of 6% on digital and bank receipts and 8% on cash receipts without any books of accounts or audit. Eg:

Particulars Amount (old tax) Amount (new tax)

Turnover 1 crore 1 crore

8% profit 8.00 lakhs 8.00 lakhs

Exemption 80C/80D . 1.70 lakhs. 0.00

Taxable income 6.30 lakhs 8.00 lakhs

Tax 0.39 lakhs 0.21

- 44ADA presumptive scheme – This is available for individual professionals/service providers.

Limit of Turnover increased to 75 lakhs to 50 lakhs.

- Analysis: For professionals/service provides up to a turnover of 75 lakhs can declare a profit of 50%. There is no requirement of books of accounts to be maintained. Eg:

Particulars Amount (old tax) Amount (new tax)

Turnover 50 lakhs 50 lakhs

50% profit 25.00 lakhs 25.00 lakhs

Exemption 80C/80D 1.70 lakhs. 0.00

Taxable income 23.30 lakhs 25.00 lakhs

Tax 5.12 lakhs 4.50 lakhs

- Processing days of ITR reduced from 93 days to 16 days.

Analysis: Why it is a welcome move -Refunds will get refunded between 5 to 30 days with faster processing time and also orders issued quickly.

- Standard deduction under new tax regime to be 52,500 for salary up to 15.5 lac.

Analysis: Tax net payable can reduce.

- Income tax- rebate increased limit to 7 lakhs in the new tax regime.

Analysis: More money in your pocket to spend.

- The limit for tax exemption on leave encashment on retirement of non-government salaried employees to increase to Rs. 25 lakhs.

Analysis: A very good initiative this year. Salaried class should feel happy that leave encashment on retirement can go without tax.

- TDS rate to be reduced from 30 per cent to 20 per cent on taxable portion of EPF withdrawal in non-PAN cases.

Analysis: More money in the pocket.

- New co-operatives that commence manufacturing activities till 31.3.2024 to get the benefit of a lower tax rate of 15 per cent, as presently available to new manufacturing companies.

Analysis: This is a very good boost for cooperatives to enter manufacturing like agri, food etc with a lower rate of tax of 15% compared to earlier 25%. Also, creates rural employment and burden on urban areas might lessen.

- Date of incorporation for income tax benefits to start-ups to be extended from 31.03.23 to 31.3.24.

Analysis: Another welcome move, one more year of benefit for startups. Planning to start LLP, OPC or Pvt Ltd, start before 31.3.24 and be eligible for tax benefits.

- Start-up provide the benefit of carry forward of losses on change of shareholding of start-ups from seven years of incorporation to ten years.

Analysis: This really helps start-ups to bring new fund infusion by new shareholders and eligibility of losses really in future helps offset against profit even with new shareholding pattern.

- Deduction from capital gains on investment in residential house under sections 54 and 54F increased to Rs. 10 crores from existing 5 crores.

Analysis: As a person having capital gains from sale of property, now you have the option to invest up to 10 crores on a property which was earlier 5 crores. That means the balance 5 crores was taxable under Capital Gains. Now, you can invest completely 10 crores on property purchase and reduce your tax to 0.

- Removing the minimum threshold of Rs.10,000/- for TDS .

We need more clarity, will update. There may be TDS applicable without threshold limit on some of the payments.

- Co-operatives to withdraw cash up to Rs 3 crores in a year without being subjected to TDS on such withdrawal.

Analysis: Will help cooperatives function more effectively without the burden of TDS being blocked.

Custom Rate:-Highlights of the Budget

- India produced 31 crore units of cameras in 2022. Relief of custom duty on import of certain parts like camera lens for use in manufacture of camera module of cellular mobile phone reduced to zero.

Analysis: Will boost camera production in India.

- Concessional duty on lithium-ion cells for batteries extended for another year.

- Manufacture of TV on parts of cells, custom duty lowered to 2.5%.

Analysis: Truly helps Make in India.

- Electric chimney basic duty increased from 7.5% to 15%

- Heat coil basic duty decreased to 15% from 20%.

- Denatured ethyl alcohol Basic Custom Duty reduced to 2.5%.

- Marine products- Shrimp feed duty reduced.

- Seeds of lab grown diamonds, basic custom duty reduced.

- Some products of import of iron & steel, basic customs duty has been reduced for some items and removed for some items.

Need more clarity on items, will update.

- Some cigarettes to be costlier by 16%.

Analysis: Statutory Warning: Smoking is injurious to health. Those who don’t heed advice, it will pinch your pocket as well as health.

- Crude glycerin for use in manufacture of epicholorhydrin reduced basic custom duty to 2.5% from 7.5%.

- Will help dye industry, textiles, print, automotive and ink manufacturing industry. Cost of raw material gets lowered by 5%, which is a big amount for all manufacturers.

- Compounded rubber basic customs duty increased to 25% from 10% or 30 per kg whichever is lower.

- Duty increased to encourage Indian manufacturers and reduce imports, thereby decreasing foreign currency outflow.

- Analysis The following table of custom duty reduction is keeping in mind boost of exports of finished goods and thereby realizing the dream of Made in India. The reduced import duties are going reduce the cost of manufacturing and increase competitiveness in international market by passing on the benefits and thereby foreign currency inflow increases.

| S. No. | Commodity | Existing (%) | New (wef 02/02/23) (%) | |

| I. | Agricultural Products | |||

| 1. | Pecan Nuts | 100 | 30 | |

| 2. | Fish meal for manufacture of aquatic feed | 15 | 5 | |

| 3. | Krill meal for manufacture of aquatic feed | 15 | 5 | |

| 4. | Fish lipid oil for manufacture of aquatic feed | 30 | 15 | |

| 5. | Algal Prime (flour) for manufacture of aquatic feed | 30 | 15 | |

| 6. | Mineral and Vitamin Premixes for manufacture of aquatic feed | 15 | 5 | |

| 7 | Crude glycerin for use in manufacture of Epichlorohydrin | 7.5 | 2.5 | |

| 8 | Denatured ethyl alcohol for use in manufacture of industrial chemicals. | 5 | Nil | |

| II. | Minerals | |||

| 1 | Acid grade fluorspar (containing by weight more than 97 per cent of calcium fluoride) | 5 | 2.5 | |

| III. | Gems and Jewellery Sector | |||

| 1. | Seeds for use in manufacturing of rough lab-grown diamonds | 5 | Nil | |

| IV. | Capital Goods | |||

| 1. | Specified capital goods/machinery for manufacture of lithium-ion cell for use in battery of electrically operated vehicle (EVs) | As applicable | Nil (up to 31.03.2024) | |

| V. | IT and Electronics | |||

| 1. | Specified chemicals/items for manufacture of Pre-calcined Ferrite Powder | 7.5 | Nil (up to 31.03.2024) | |

| 2. | Palladium Tetra Amine Sulphate for manufacture of parts of connectors | 7.5 | Nil (up to 31.03.2024) | |

| 3. | Camera lens and its inputs/parts for use in manufacture of camera module of cellular mobile phone | 2.5 | Nil | |

| 4. | Specified parts for manufacture of open cell of TV panel | 5 | 2.5 | |

| VI. | Electronic Appliances | |||

| 1. | Heat coil for manufacture of electric kitchen chimneys | 20 | 15 | |

| VII. | Others | |||

| 1. | Warm blood horse imported by sports person of outstanding eminence for training purpose | 30 | Nil | |

| 2. | Vehicles, specified automobile parts/components, sub-systems and tyres when imported by notified testing agencies, for the purpose of testing and/ or certification, subject to conditions. | As applicable | Nil | |

| Commodity | Rate of duties | |||

| From (per cent) To (per cent) | ||||

| I. | Chemicals | |||

| 1. | Styrene | 2 (+0.2 SWS) | 2.5 (+0.25 SWS) | |

| 2. | Vinyl chloride monomer | 2 (+0.2 SWS) | 2.5 (+0.25 SWS) | |

| II | Petrochemical | |||

| 1 | Naphtha | 1 | 2.5 | |

| (+ 0.1 SWS) | (+0.25 SWS) | |||

| III. | Precious Metals | |||

| 1. | Silver (including silver plated with gold | 7.5 | 10 | |

| or platinum), unwrought or in semi- | (+ 2.5 | (+ 5 AIDC+ | ||

| manufactured forms, or in powder | AIDC+ 0.75 | Nil SWS) | ||

| Form | SWS) | |||

| 2. | Silver dore | 6.1 | 10 | |

| (+ 2.5 | (+ 4.35 | |||

| AIDC+ 0.61 | AIDC+ Nil | |||

| SWS) | SWS) | |||

| IV. | Gems and Jewellery Sector | |||

| 1. | Articles of Precious Metals such as gold/silver/platinum | 20 (+Nil AIDC +2 SWS) | 25 (+Nil AIDC +Nil SWS) | |

| 2. | Imitation Jewellery | 20 or ` | 25 or ` | |

| 400/kg., | 600/kg., | |||

| whichever is | whichever is | |||

| higher | higher | |||

| (+Nil AIDC +2 or ` 40 per | (+Nil AIDC +Nil SWS) | |||

| Kg SWS) | ||||

| S. No. | Commodity | Rate of duties | |

| From (percent) …………… To (percent) | |||

| V. | Automobiles | ||

| 1 | Vehicle (including electric vehicles) in | 30 | 35 |

| Semi-Knocked Down (SKD) form . | (+3 SWS) | (+Nil SWS) | |

| 2 | Vehicle in Completely Built Unit (CBU) | 60 | 70 |

| form, other than with CIF more than USD 40,000 or with engine capacity | (+6 SWS) | (+Nil SWS) | |

| more than 3000 cc for petrol-run | |||

| vehicle and more than 2500 cc for | |||

| diesel-run vehicles, or with both | |||

| 3 | Electrically operated Vehicle in | 60 | 70 |

| Completely Built Unit (CBU) form, other than with CIF value more than | (+ 6 SWS) | (+Nil SWS) | |

| USD 40,000 | |||

| VI. | Others | ||

| 1. | Bicycles | 30 (+ Nil AIDC +3 SWS) | 35 (+ Nil AIDC +Nil SWS) |

| 2. | Toys and parts of toys (other than parts of electronic toys) | 60 (+Nil AIDC+ 6 SWS) | 70 (+Nil AIDC+ Nil SWS) |

| 3. | Compounded Rubber | 10 | 25 or ` 30/kg., whichever is lower |

| 4. | Electric Kitchen Chimney | 7.5 | 15 |

| Description of goods | Rate of excise duty | |

| From (` per 1000 sticks) | To (` per 1000 sticks) | |

| Other than filter cigarettes, of length not exceeding 65 mm | 200 | 230 |

| Other than filter cigarettes, of length exceeding 65 mm but not exceeding 70 mm | 250 | 290 |

| Filter cigarettes of length not exceeding 65 mm | 440 | 510 |

| Filter cigarettes of length exceeding 65 mm but not exceeding 70 mm | 440 | 510 |

| Filter cigarettes of length exceeding 70 mm but not exceeding 75 mm | 545 | 630 |

| Other cigarettes | 735 | 850 |

| Cigarettes of tobacco substitutes | 600 | 690 |

Welcome your suggestions, feedback, likes and share.

Brought to you by Total Solutions

Detailed analysis on trade impact will follow.

Follow us on:

Facebook: https://www.facebook.com/totalsols

Linkedin: https://www.linkedin.com/in/a-subramani/

Instagram : https://instagram.com/totalsols123?igshid=vhhhy4ozhh2q

YouTube Channel: https://rb.gy/q43drq / https://bit.ly/3ol827x

Website: www.total-sols.com