Let us understand what is MSME Udyam?

The Government of India has replaced the previous Udgyog Aadhar Registration with Udyam number with changes in classification for both manufacturing and service sectors.

Udyam registration is absolutely necessary to avail MSME benefits announced by the GOI from time to time.

Udyam Registration Number has to be generated by registering in Udyam Registration portal. Every enterprise will have only one URN number. The units can select multiple activities like manufacturing, services. On registration, permanent identity number is allotted known as UDYAM registration number. This certificate is issued named as UDYAM registration certificate. Criteria will be composite and even if one criterion exceeds the specified limit, it automatically moves to the next category.

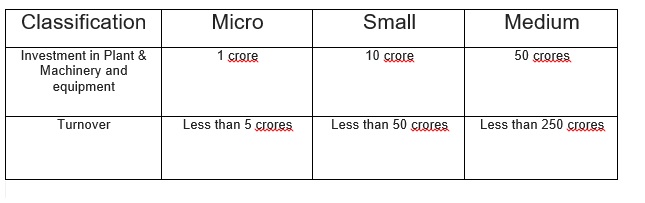

The unit has to select micro, small or medium based on the investment and turnover criteria, specified as below

The most important point to be noted is UAM is going to be linked with ITR and GSTN wherein turnover and investment from the succeeding years will be automatically incorporated in the Udyam Registration as per the ITR filed.

Registration under UDYAM registration portal:

1. No registration fees.

2. Aadhar number for Proprietor, Managing Partner from Partnership, Karta from HUF is mandatory. In case of Private Limited, Limited, LLP, Trust, Society, Cooperative Society, the organization should provide GST copy along with Aadhar.

3. If UDYAM is registered with PAN, deficiency of previous year if any shall be filed with self-declaration.

4. Each enterprise should have only one UDYAM registration. Anyone misrepresenting or suppressing self-declared facts and figures will be penalized under SEC 27 of the Act.

Registration of existing enterprises

1. Should register under EM-Part II or UDYAM and should again register under UDYAM portal on or after 1st July 2020.

2. Existing enterprises till June 30, 2020, will be reclassified as per the new criteria.

3. The existing registration prior to June 30, 2020, will be valid till March 31, 2021.

4. Any other enterprise registered with MSME should register under UDYAM registration.

Updation of Information and Transition

1. All enterprises having UDYAM registration number (URN) should update details as per ITR and GST pertaining to previous year by self-declaration.

2. Failure to update the information within the period specified in UDYAM registration portal will render the enterprise liable for suspension of its status.

3. Classification will be updated as per self-declaration of ITR and GST and also information gathered by the Govt sources.

4. In case of graduation of Micro to Small, Small to Medium or vice versa a communication will be sent regarding change of status.

5. In case of upward change of investment or turnover or both, will maintain prevailing status till expiry of one year from the closest to the year of registration.

6. The effects of the changes in the middle of the year will come into effect only in the next financial year.

7. In case of any problems with filing, one can approach the department.

8. In case of discrepancies or complaints, enquiry will be made by the concerned officer.

To know about your specific requirement of your MSME, contact us for a no-obligation meet. Contact us at 9972039806 or mail us your query at as@totalsols.in .