Looking forward to building your career in accounts? Understand the reasons for failure in interviews. Did you know that most of the companies that take young passouts as Accountants, say out of 100 companies 95, use Tally as their accounting software? So, what should be the next step? Simple…..Join a Tally program much before you are a qualified graduate and have an edge over others and get the passport to success. It is therefore important to choose an accounting institute that teaches TALLY as a tool and accounting as an art.

Why should you learn Tally software only? We have 1.8+ million users in India, also 100+ countries use Tally. Opportunity beckons for Tally qualified accountant!

We are a SKILL N UPSKILL institute and are committed to imparting Skills and further Upskill the Candidates to be successful in their Accounting, Taxation, Statutory, HR & Payroll careers. We have devised practical classes with convenient evening batches and weekend classes. Wide range of options to choose from. We run classes online hence we are Pan India.

We have 28+ years of experience in handling Accounts with taxation, statutory compliance of startups, MSME, large corporate, MNC, having trained more than 1000+ Accountant. We are a group of Chartered accountants, Company Secretaries, Cost Accountants and Experienced Professional Accountants who have started SKILL N UPSKILL- a practical way of learning.

Let us demonstrate to you practically what you can choose and learn in our flagship SKILL Practical Training. Select from the below.

1) Tally Basic

2) Tally Professional

3) INCOME TAX

4) GST

5) TDS

6) PF

7) ESI

8) PT

TALLY MASTER BUNDLE is a practical training of all the above combined as one.

What we teach is what you will be handling in your day-to-day employment or professional career. Our Assessment Certificate is your gateway to success.

A True Accountant using TALLY as software should be able to Maintain Accounts, Inventory, Taxation & Statutory as per statute. Compute & File Tax returns as applicable and also able to generate required MIS like Periodical RECEIVABLE/PAYABLE/PROFIT AND LOSS – INVOICE/TERRITORY/PRODUCT WISE PROFIT, and many more.

Entrepreneurs are on the lookout for True Accountants. Would you like to be one?. If you would like to make your journey in Accounts, listen carefully.

We are not lecturers or coaching centres. We are working professionals in Accounting, Taxation, Statutory, Finance who are working with industry as their clients in delivering the above services, so what you get is not lecture on a whiteboard from texts. You learn the practical way from the real-time records which the industry uses to maintain its Accounts & Allied functions.

*Before we start you should know that we make you learn the practical way*

· Heads of Accounts

· What is group

· What is expense

· What is sales/income

· What is Asset

· What is Liability

· What is Debit

· What is credit

*Rules of Accounts are as simple as below but we make you understand the practical way it impacts.*

Dr the receiver – Cr the giver

Dr what comes in – Cr what goes out

Dr all losses/expenses – Cr all gains/Income

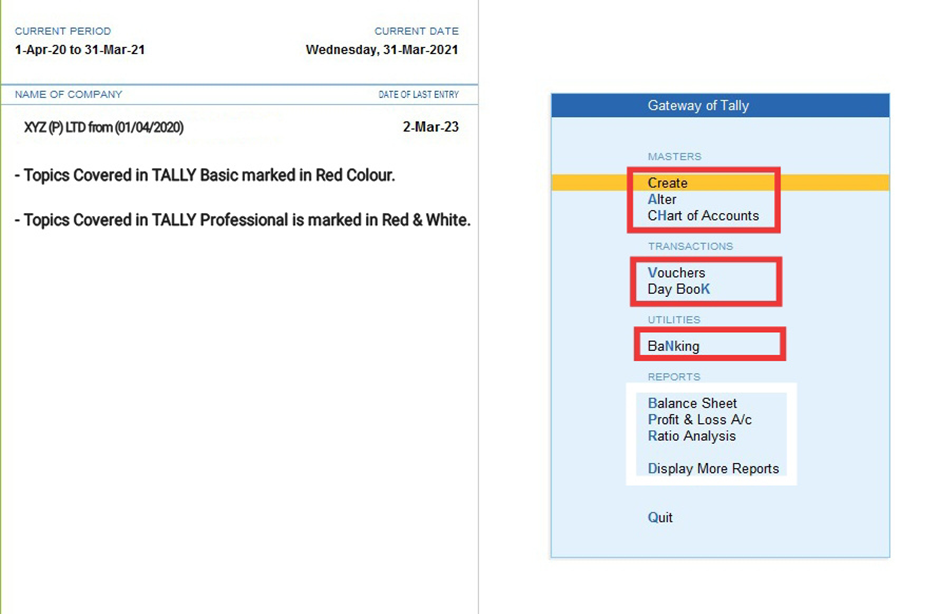

TALLY a tool. What you learn in TALLY Basic is marked in Red in below Screenshot. We decipher the same one by one through a practical approach and make you understand and love the subject.

TALLY a tool that you learn in TALLY Professional is marked in Red & White in the Screenshot below. We decipher the same one by one by practical approach make you understand and love the subject.

What Next? Practical training in all

*Applicability – Coverage – Rates – Returns*

1) INCOME TAX

2) GST

3) TDS

4) PF

5) ESI

6) PT

7) TALLY MASTER BUNDLE is a comprehensive course including TALLY Basic & TALLY Professional including the above 6 points.

Sounds Good? Book your course module by module or finish it in one shot by booking the Tally Comprehensive Bundle package. We are here to support you either during the class or outside the class and post the training be a part of our WhatsApp Tax Group, stay updated on what is happening and have your questions answered for a period of 1 year for free