Understanding the Regimes: Old vs New

Every year, the dilemma persists for individual salaried taxpayers, which tax regime to choose? With the company deducting TDS on salary in advance, navigating between the old and new tax regimes can be perplexing. The question arises: Which offers more benefits?

Let us delve into this deeper. We are here giving examples of annual salaried income of 10lakhs, 20lakhs, 30lakhs, 4 lakhs, 50lakhs and 60lakhs with a comparison chart of old vs new regime.

When choosing the old regime, we have considered that you have taken the exemptions cited. However, if any of these is discontinued, the working will differ. So tax also will change and you need to keep this in mind.

Flexibility in Regime Selection

Fortunately, salaried individuals have the liberty to switch between tax regimes without constraints every year. Whether it’s opting for the old regime for familiarity or embracing the new for potential advantages, the choice is yours. Even if you have declared already to your employer and accordingly employer has deducted TDS, still you can switch over at the time of filing.

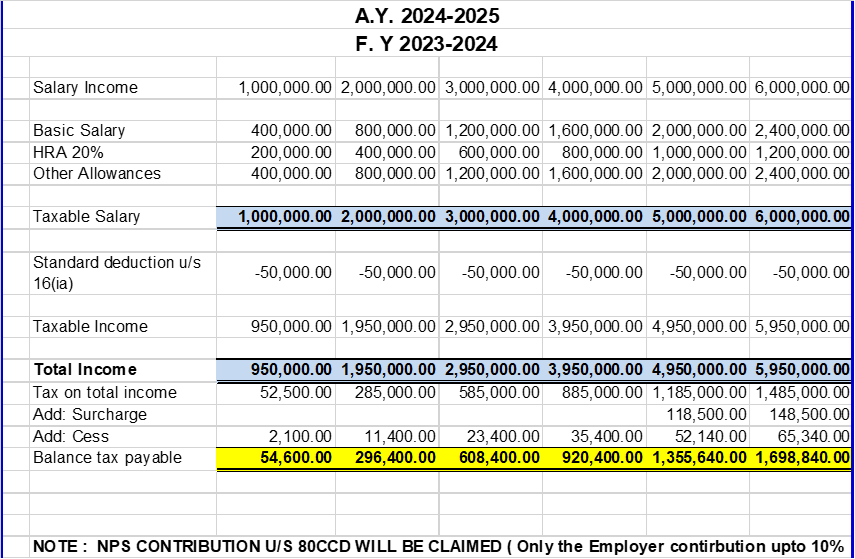

NEW TAX REGIME WORKINGS

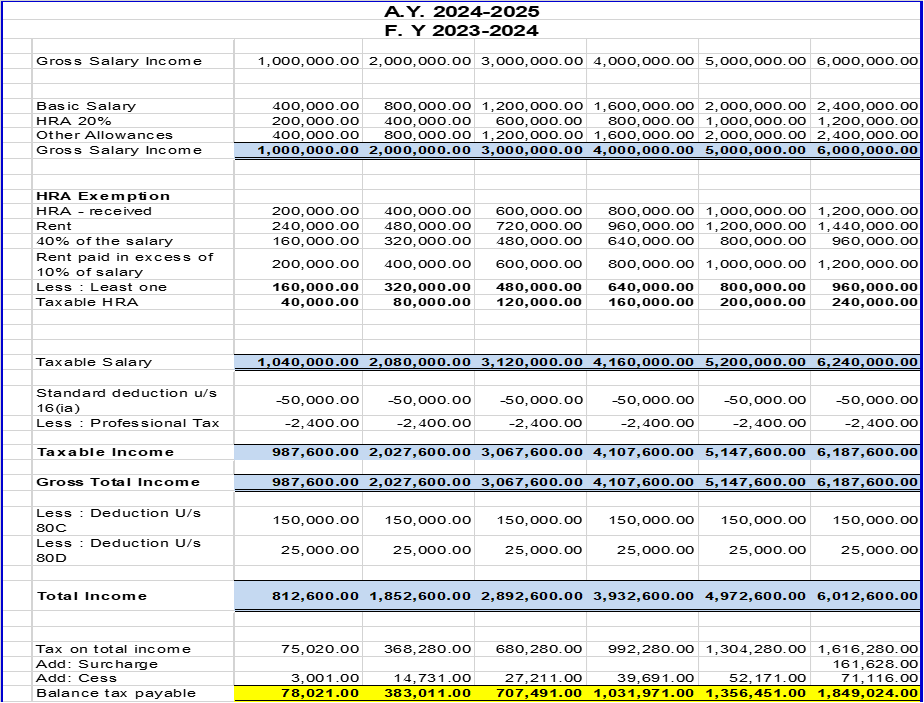

OLD TAX REGIME WORKINGS

Leveraging Allowances: A Closer Look for tax saving under old regime.

Many find themselves questioning their company’s stance on certain allowances, particularly those lumped under “Others” and “Flexi.” Companies are not categorizing allowances explicitly, it doesn’t necessarily preclude you from claiming deductions as deductions are allowed as exemptions under the Income Tax Act. However, you need to check for eligible allowances that one can claim in the year by thorough documentation and substantiation of claims with proof are imperative. You need to use your prudence and logic that the claiming of allowances should be within a reasonable limit. You can claim the following allowances if you have documentary evidence:

- LTA

- Relocation allowance.

- Children education allowance.

- Hostel Expenditure allowance.

- Professional Knowledge upgradation.

- Mobile allowance.

- Internet allowance.

- Research Allowance.

- Uniform Allowance.

- Interest incurred on borrowed capital.

- Petrol, Driver Salary, Car Maintenance Allowance.

- Books & Periodical & Journals Allowance.

- Food coupon.

OTHERS: These exemptions are available only for Old Tax Regime, except National Pension Scheme up to 10% of employer contribution in new regime.

Some of such investments are given below which are eligible for an exemption under Section 80C, 80CCC and 80CCD (1) up to a maximum of Rs 1.5 lakh, additionally NPS Rs. 50,000/-. In total, Rs. 2 lakhs. However, in addition employer’s contribution of 10% of NPS will be allowed.

- National Pension Scheme

- Life insurance premium

- Equity Linked Savings Scheme (ELSS)

- Employee Provident Fund (EPF)

- Annuity/ Pension Schemes

- Principal payment on home loans

- Tuition fees for children

- Contribution to PPF Account

- Sukanya Samriddhi Account

- NSC (National Saving Certificate)

- Fixed Deposit (Tax Savings)

- Post office time deposits

- Medical Expenditure and Medical Insurance Premium (Section 80D) :

- Deduction for Education Loan (Section 80E)

Donations (Section 80G)

Honesty Pays Off

While you have the flexibility to claim exemptions not availed through your company, honesty is paramount. Declaration of all incomes, including interest, rent, and capital gains not reflected in Form 16, is obligatory. Failure to do so may lead to unwelcome notices from the tax authorities. You are advised to go through 26AS, pertaining to you in the income tax website. It will give you TDS deducted details of all your income wherein you are expected to declare in your returns. You are also advised to check AIS, which will give you all your high value transactions supposed to be declared by you.

Vigilance in Tax Filing

In recent times, the scrutiny on salaried taxpayers has intensified. Notices have surged by 80% this financial year for the following:

- Undisclosed incomes.

- High value transactions.

- Dubious deduction claims of very high HRA.

- Inconsistent insurance premiums and medical claims.

- High value bank and credit card transactions.

This mandates the need for vigilance. Regularly monitoring the tax department’s website is advised.