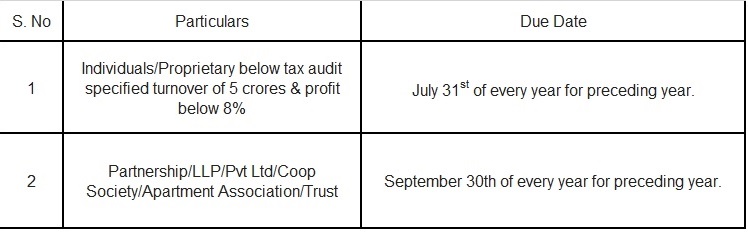

The Government of India mandates that the individuals and business of all types file income tax returns as per the specification stipulated. The various dates are here below:

How to file: First and foremost let us understand what income tax is. Income tax is a tax on profit or tax on salary as stipulated by GOI. Then the next question arises, how do I compute the tax for the same. You need to compute your tax based on your books of accounts from which profit and loss account and balance sheet are drawn, either audited or unaudited as specified. The profit and loss account is nothing but revenue over expenditure. If the revenue is more, it is profit. If expenditure is more, then it is loss. On computation of this on profit, the slab rate of tax is computed.

In case of salary, the various exemption limits are provided by the IT department. Accordingly, the salary is deducted by various exemptions and also added with other income if any and thereby it arrives at the total income. If the total income is taxable under the income tax, the prescribed tax needs to be paid.

Want to know more or facing difficulties in filing Income Tax Return? Please contact us at Total Solutions. Get your ITR filed in just 1 day. You can also Book an appointment with us and can get 30 minutes FREE session.